Gain valuable market insights and connect with our local agents today to make informed real estate decisions in Austin. Our blogs offer transparent outlooks and data for current and prospective homeowners and renters, whether you’re buying or selling.

Mortgage Rates Will Continue to Respond to Inflation

In August, mortgage rates hit their highest level since 2001, and are expected to stay at their current elevated levels for a while in reaction to the Federal Reserve‘s (Fed) decision to pause its tightening monetary policy. In turn, mortgage origination volumes will remain under pressure for the remainder of the year.

The Freddie Mac Primary Mortgage Market Survey, which focuses on conventional and conforming loans with a 20% down payment, shows the 30-year fixed rate averaged 7.18% as of August 31st, down from last week’s 7.23%. The 30-year was at 5.66% a year ago at this time.

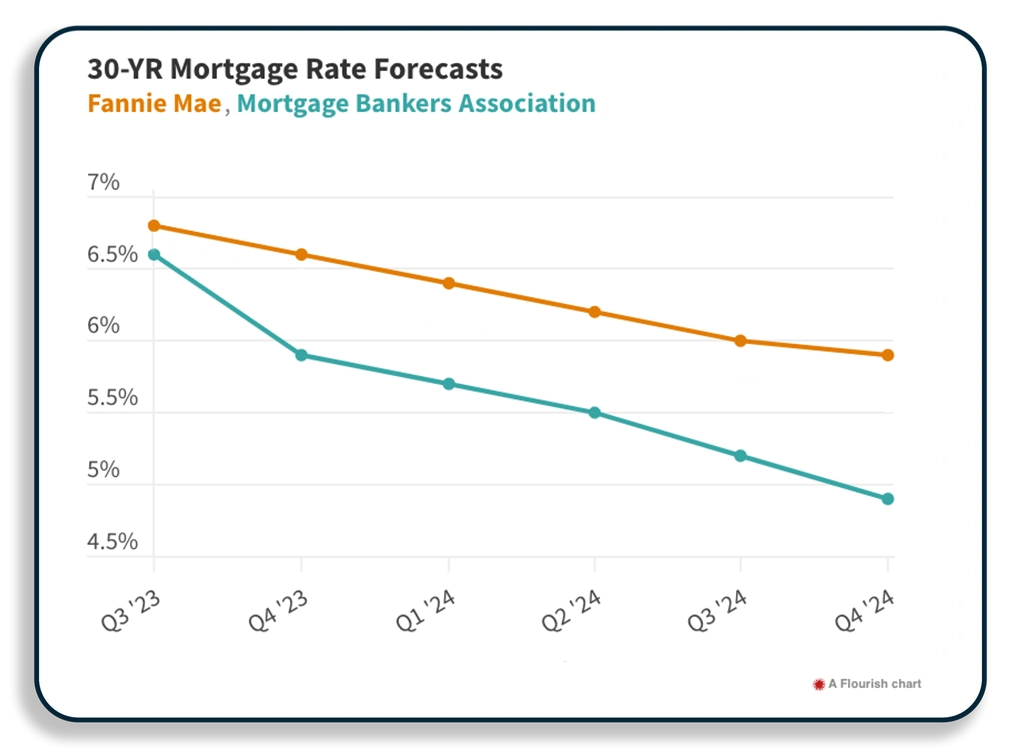

Fannie Mae’s Housing Forecast for August 2023 shows rates averaging to 6.8% to 6.7% by the end of 2023 and continuing to decrease through 2024.

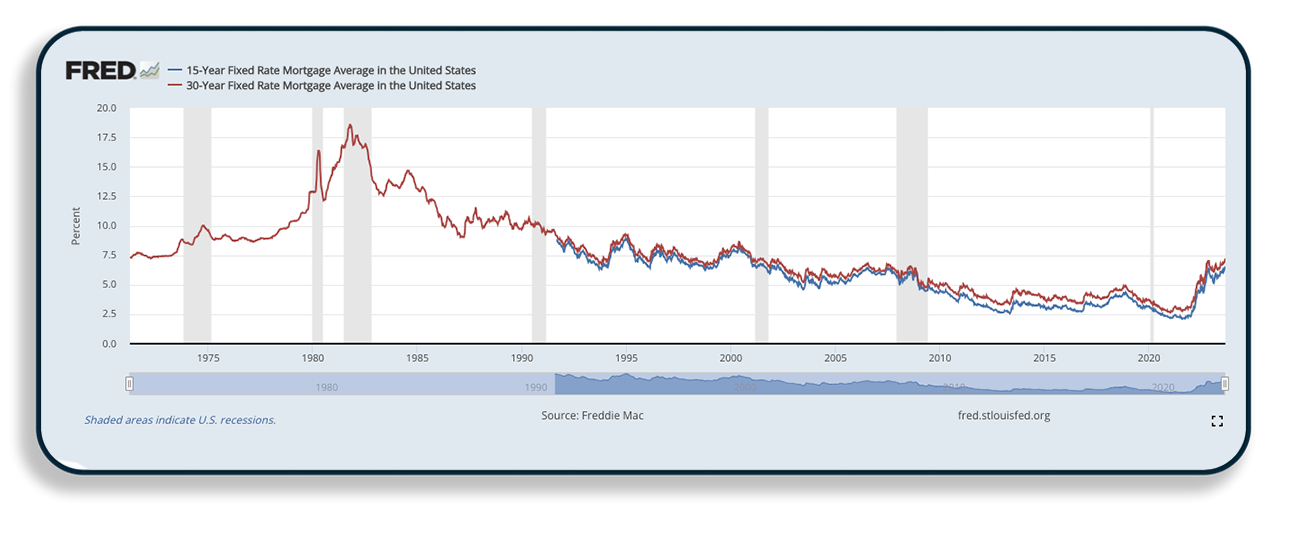

30-Year Fixed Rate Mortgage Average and 10-Year Treasury Yield (1972-2023)

Source: FRED, 30-Yr Fixed, 10-Yr Treasury Yield

The current spread of 2.925 as of August 30th is larger than the 50-year 1.7 average spread because mortgage companies are charging more as they know the mortgages are going to get refinanced once the rates come back down.

Will Mortgage Rates Come Back Down?

Rates will come down, it’s just a matter of time, according to economists at Fannie Mae and the Mortgage Bankers Association. When rates do come down, it will improve affordability for prospective home buyers. Mortgage demand has been up as rates continue to ease from their 2022 highs.

The latest monthly Housing Forecast from Fannie Mae, has the average 30-year fixed rate remaining high at 6.8% during the third quarter of 2023, pulling back slightly to around 6.6% by year-end. The mortgage giant doesn’t expect rates to dip below 6% until the fourth quarter of 2024. All told, Fannie Mae expects the 30-year mortgage rate to average 6.6% in 2023 and 6.1% in 2024.

Meanwhile, MBA’s latest Mortgage Finance Forecast has a more optimistic outlook, with the 30-year mortgage rate falling to 5.9% by the end of 2023. Conditions improve in 2024, with the industry group projecting rates to fall below 5% in the fourth quarter.

Pro Tip: Learn more about how buyers and sellers can win with 2-1 Buydowns. It may be possible to negotiate a rate “buydown” paid by the seller. This seller concession can reduce the amount you need to pay each month. Many sellers prefer this to reducing the sale price of their home. When rates fall in the future you may be able to refinance to a lower rate.

The Great Recession had too few buyers and the forecasted 2023 housing market will likely have too few sellers, which may prevent home values from plummeting. Higher interest rates will continue to temper demand while historically lower inventory, coupled with the demographically-driven demand of Millennials will help keep pressure on prices. Which force will win out? Time will tell as mortgage rates respond to inflation.

BOTTOM LINE: Take action now and explore your options. Instead of trying to time the market, sit down with a local real estate expert who can provide valuable insights for your home search or home sale goals. Discover how the current bright spots in our cooling market can create unique opportunities for buying or selling. Keep in mind that mortgage rates are highly volatile, so stay updated by consulting with your mortgage professional for the latest information.

Follow us on social media for breaking market updates, graphics, videos, and more @realtyaustin, and subscribe to our market newsletter by clicking sign up in the top right corner of our website.